Do you know that the value of over-the-counter contingent claims, foreign exchange markets, pre-dated tradable agreements and products were of the value of over US$542 trillion in the first 6months of 2017?

Despite this impressive feat, it is quite discouraging to know that the current model of the financial services sector is still centralized with banks, prime brokers and large institutions controlling the majority of the activities in the sector. Simply put ‘Their Say is Final’.

Over the years, clients have had to deal with several issues such lack of transparency from brokers, the influence of trade executions, long settlement of transactions etc., and this has further created a harsh environment for traders. Financial service companies, large institutions and prime brokers have turned themselves to gods in the industry because they know that these clients do not have any choice but to keep using their services, and clients, on the other hand, though already fed up with the model, but do not have anywhere to run to.

The financial market is currently centralized and is in the grasp of banks and other service providers. Services providers are not easily understood and this causes unstable tilts in the Market values and also they have brought unnecessary service charges for services rendered. Daily, clients are being faced with several issues such as:

little understanding of the service providers and cause of the charges imposed

Transaction settlement and service exchange issues take days before it gets

lack of options in the service provision.

Funds are transferred to broker’s account, which in turn places a great risk to the client

Prices and trade executions are often influenced by brokers

Lack of trust and integrity between clients and brokers

It is therefore evident that the current market is in need of a total overhaul. There is an urgent need for an ecosystem that will not only address the highlighted issues but also provide an enabling environment. However, this can be achieved by utilizing blockchain technology due to its transparent, immutable, secure, open and fast nature.

Having realized the challenges with the current model, TradeConnect is proposing an entirely different model to revitalize the global trading ecosystem. TradeConnect aims to leverage on blockchain technology to provide a multi-asset trading network that will enable traders to easily trade any financial asset immediately without the need of a middleman.

TradeConnect limited is an affiliate of the ThinkMarket group of companies. ThinkMarket is an approved financial service provider in the UK and Australia with over a decade of a Knowledge-gathering expedition in the industry which is essential for the member(TradeConnect) on its way to surpass expectations made. Though it is limited to the retail wing of the market now, it's going to be expanding into other wider areas of the market such as the institutional and corporate derivative trading markets.

TRADECONNECT’S SOLUTION

The aim of TradeConnect is to create a multi-asset blockchain based trading network that connects individuals. TradeConnect will allow people trade with each other on the network and attract the mildest service charge with the recording and service provision provided off the network to ensure speed in the delivery. This will further create a multicomponent advanced market that will impede and provide equality in the network.

With the TradeConnect network, traders will:

have full authority and access to their assets,

no longer have to rely on brokers and other intermediaries before they can freely trade their financial assets,

enjoy reduced fees, as only connection fee is paid when carrying out a trade using the network,

enjoy swift transaction settlement because settlement occurs almost immediately,

be rewarded for further adding liquidity to the system.

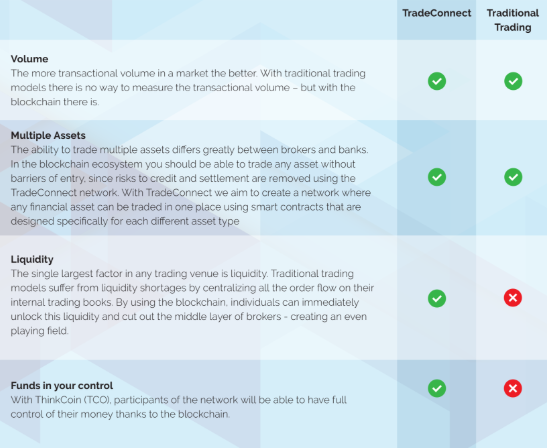

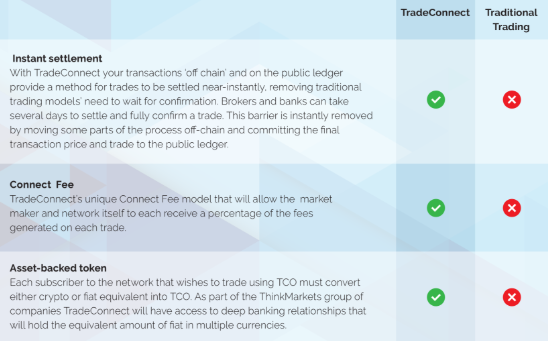

Below clearly shows how TradeConnect is different from the traditional trading system.

THE TRADECONNECT NETWORK MODEL

Before delving into how the TradeConnect model works, it’s best to identify and establish the participants and their specific functions in the TradeConnect network. The participants are of two categories, namely Subscribers and Providers. The Subscribers are further divided into the Market Makers and Counterparties (Takers). However, the Providers are Relays, TradeConnect Contract, and Oracles.

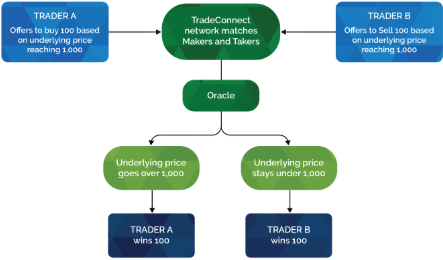

The market makers are individuals or trading entities who help to generate the conditions of a contract to trade a certain financial product. However, the Counterparties who are often referred to as the Takers will be able to browse through and accept the contracts created and offered by the makers, by signing with their private keys. Upon signifying interest, the trading contract is instantly submitted to an oracle which in turn helps to seal the contract result before submitting it to the smart contract.

The TradeConnect contract is saddled with two responsibilities. First, to help store the locked up ThinkCoin tokens being traded by the concerned parties, and second, is to sort out the trades made by the parties off-chain. The Relays is like a repository of all the off-chain stores of trading offers which were generated by the Makers. As it was earlier stated that the Oracle helps to submit the signed contract results to the smart contract, it also helps to convey information and eventually determine the contract results.

Trades on the ThinkCoin network are settled off-chain because the typical blockchain has some defects. For example, the typical blockchain would normally require that each trade contract is offered as a smart contract. This directly translates to a lot of delay on the platform and also transaction wise, because a notable number of ethereum transactions would be needed irrespective of if each trade is accepted by the counterparties or not.

The ability for traders to get the best price and tailored offers is quite a challenge in the current ecosystem because most of the liquidity is centralized by banks, brokers and etc., This has further created liquidity inefficiency. To address this, TradeConnect will leverage on the latest AI concepts to develop a machine learning scoring model. This scoring model which will be referred to as 'Personas' will help personalize trading. The Personas will help to understand the entire activities of a subscriber on the platform and then uses the information to build a tailored and well-defined roadmap that greatly matches the participant with the right trade on the network.

TOKEN

To raise money to aid the development of the network in all phases, the ICO of the ThinkCoin token (TCO) is being adopted as a customized legal tender which will support trading on the TradeConnect network. The cryptocurrencies supported for the interim Include bitcoin, bitcoin cash, Ethereum, Dash, monero, litecoin and TCO (ThinkCoin token). The ThinkCoin is a utility token that will be issued in the form of an ERC-20 token.

Total Supply: 500,000,000 TCO

Token symbol: TCO

Hard cap: 30,000,000 USD

Soft Cap: 5,000,000 USD

Current price: 1 TCO = 0.3 USD

Accepted currencies: ETH, BTC, BCH and Fiat

The token allocation is also transparently shared among the different classes of benefactors of the network with Pre-ICO and ICO participants getting the most allocation and the bounties at the bottom, with the retained and the team being the middle members of the scale of preference of the TradeConnect, based on the token allocation.

TEAM AND ADVISORS

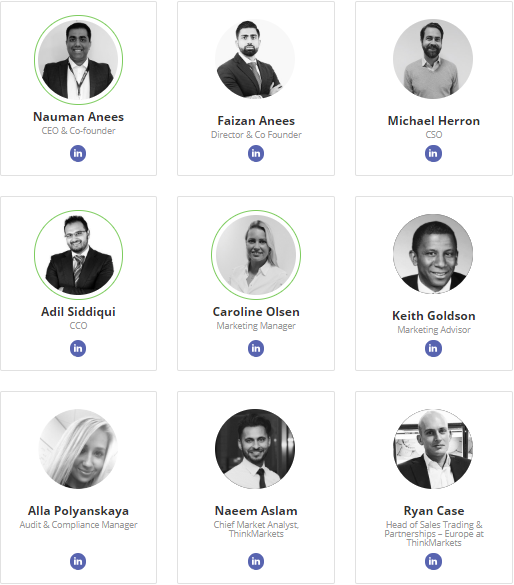

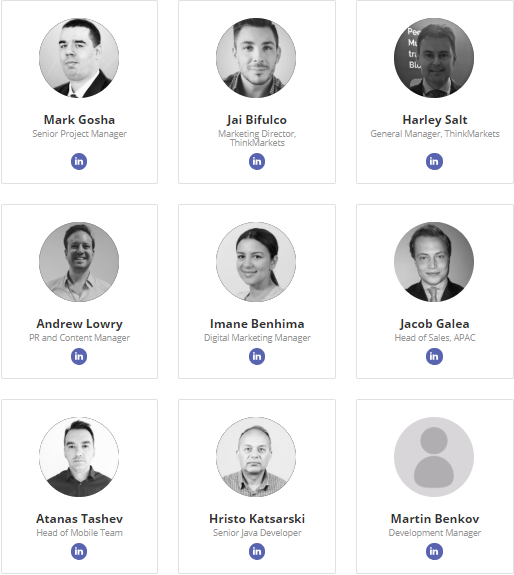

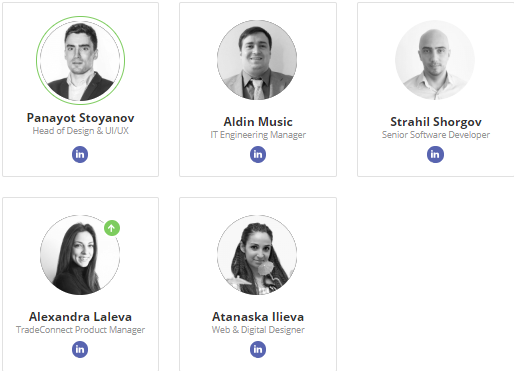

The promising TradeConnect is being run by a group of brilliant and versatile professionals headed by the three co-founders Nauman Anees(Chief Executive Officer and co-founder), Faizan Anees (Director and co-founder), Roldolfo Festa Bianchet(Chief ExecutiveOofficer and co-founder of Tradeinterceptor). Other members of the team include Michael Herron (Strategic Advisor), Adil Siddiqui(Director of Operations) with Harshad Kale (Director of Finance), Jai Bilfuco(Marketing Manager ThinkMarket), Andrew Lowry(PR and content manager) and a handful of other professionals.

The Technology team include Atanas Tashev(head of mobile team), Martin Benkov(development manager), Aldin Music (IT engineering manager) and a squad of other pros.

CONCLUSION

With the introduction of TradeConnect into the daily life of the regular financial market users, transparency will be reintroduced back on a more serious tone into the industry. Also, with more attention being given to new user acquisition and marketing sector of the network, the blockchain is sure to deliver because for the fact that you get more service for a lesser fee, is also a guarantee that any well-meaning financial marketer will be eager to trade on TradeConnect. The problems of lack of trust and integrity in the current financial market and no peer to peer trading among other problems of the current banking system will also be addressed and surely eliminated, coupled with the fact that It also supports a wide range of liquid cryptocurrencies as a concomitant in the trading.

Basically, for a memorable financial marketing experience, TradeConnect is all one can think of as it has all the needed characteristics of an ideal financial network.

Kindly visit https://www.thinkcoin.io/for more information.

Whitepaper: https://docsend.com/view/5rxxi9c

ANN: https://bitcointalk.org/index.php?topic=3077146.0

Twitter: https://twitter.com/ThinkCoinToken

Telegram: https://t.me/thinkcointoken

Medium: https://medium.com/thinkcointoken

BTT profile: https://bitcointalk.org/index.php?action=profile;u=1826813

ETH: 0x162b4862c2Aa74eB272974EdF91B754a57A5f01e

Tidak ada komentar:

Posting Komentar