Homelend - a unique platform for obtaining a loan for blockbuster technology!

The process of obtaining such a loan is very complicated and time-consuming, it is necessary to collect enough documents to count on a positive result. Certain intermediaries are engaged in making an application, which prevents the client from independently controlling the process and entailing additional financial costs. Outdated evaluation criteria do not allow young people to get the money they need to realize their own potential. Mortgage loans are very popular today, many people are thus trying to build their dream home or start their own business. The archaic mortgage industry is obsolete, today the developers of the decentralized platform Homelend, are trying to use the capabilities of the block, as well as intellectual contracts for its modernization.

Homelend Features

Homelend will use a combination of smart contracts and distributed accounting technology to connect individual lenders and borrowers through an end-to-end platform. This will automate and optimize the process of creating a mortgage for all parties involved.

The Homelend platform is designed with all possible details in mind, and provides users with an unlimited number of different user benefits. It has optimized processes using smart contract operations. This will ensure the unlimited processing speed of documents within twenty (20) days. This means that the process of applying for a mortgage is simplified, and it also becomes more reliable and faster.

The process becomes transparent and user-friendly. This becomes possible, since the creditor can control the entire crediting process and verify the authenticity of the process and its reality as a whole.

How does Homelend work?

Homelend is building a decentralized platform for mortgage lending, which will have two main objectives:

To modernize an aging mortgage system to make it more efficient, more profitable and customer-oriented To

expand the ability to own real estate for a new generation of borrowers, meeting their special lifestyle and needs

To achieve these goals, Homelend will use blockchain technology and intellectual contracts to bring together parties decentralized market. Individual borrowers and lenders will be able to interact in the Homelend market. Homelend is an end-to-end system that processes all phases of the mortgage process from the early stages of the application to the final stages of paying your last mortgage payment.

Borrowers will be able to access three different ways of crediting P2P on the Homelend platform, including pure reverse processing, consolidation and auction. In each of these ways of lending, the flow of financial resources is controlled and executed by intellectual contracts without the need for intermediaries or financial intermediaries. Each financing method can also divide the mortgage into "pieces".

To implement this, the developers use the capabilities of the block, as well as intellectual contracts, to allow the parties to interact advantageously in the vastnesses of the decentralized market. Borrowers will be able to use the services of creditors on really favorable terms.

There are different ways of lending, each borrower will be able to choose the option that suits his preferences:

CrowtFunding

This method of financing is considered the most simple. The borrower will be able to collect "pieces" of mortgages from different creditors. This is beneficial to small companies that provide small loans. All conditions for such cooperation will be fixed in the intellectual contract.

Unification

This is an excellent opportunity to provide a decentralized Homelend platform with flexibility in dealing with economic issues. Creditors will be able to invest in the project even before the approval of applications, they buy certain "pieces" in order to make a profit in the future.

Auction

Investment opportunities for everyone - borrowers will be able to make a choice from a variety of proposals, given their own preferences and capabilities. In addition, creditors themselves will also be able to find customers with excellent ratings and willingness to pay good interest. Such cooperation is really mutually beneficial. Creditors will have to build their proposals in a healthy competition in the best way for clients to attract borrowers to their project. The main advantage of this method is that creditors can change the terms of the application, personalizing it for a specific client.

ICO Homelend

The main function is to provide access to the Homelend platform. This utility token also plays an important role in providing a fast, smooth and user-friendly workflow that is unified and secure.

Name of the token: HMD.

Total volume of tokens: 250 million HMD.

Standard: ERC-20.

The price: 1 ETH = 1,600 HMD.

Accepted currencies: BTC, ETH, USD.

Softcap: $ 5,000,000.

Hardcap: $ 30,000,000.

Of the total volume of deliveries of tokens, 36% are for public sale, 28% for pre-sale, 20% for reserve fund, 8% for consultants and bounty, and 8% for founders.

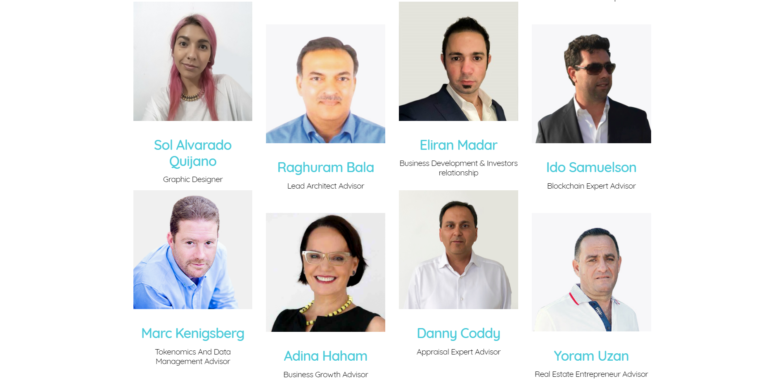

Homelend Team

The project has a strong and highly qualified team, which in my opinion is able to bring the project to the highest level in the shortest possible time and I hope they succeed.

Homelend co-founded Itai Cohen (CEO) and Netanel Bitan (CTO). Other listed members of the executive team include Ricardo Enriquez (Chief Innovation Officer) and Amir Nahmias (chief business officer).

Homelend collaborates with BrightNet, GenesisZero, NetObjex and Market Allross to revitalize its platform.

Homelend is based in Zug, Switzerland. The company was registered in 2016.

Conclusion

The creators of Homelend want to change this position, acting openly and honestly. Borrowers will be able to establish effective cooperation with creditors, constantly monitor the status of their loan. This approach allows you to build trust relationships within the segment. The absence of intermediaries can reduce costs - the use of blocking technology allows you to work directly, avoiding the help of intermediaries who require serious commission for their services. Intellectual contracts operate unerringly, allowing the parties to create favorable conditions for cooperation. Blocking allows to prevent the introduction of fraudulent schemes in the functional of the decentralized Homelend platform. Therefore, users and creditors can be assured of the safety of their funds, as well as personal information provided during lending. For those, who chooses a project for investment, pay attention to Homelend, a very worthy candidate: an excellent and necessary idea, a professional team, well-known advisors, just great ratings on all independent venues. Participate in Homelend or stay away - it's up to you. But the project is really unusual and attractive for investors!

For more information, please click on the link below:

Website: https://homelend.io

Whitepaper: https://homelend.io/files/Whitepaper.pdf

Telegram: https://t.me/HomelendPlatform

Twitter: https://twitter.com/homelendhmd

Facebook: https://www.facebook.com/HMDHomelend

ANN thread: https://bitcointalk.org/index.php?topic=3407541

Profile: https://bitcointalk.org/index.php?action=profile;u=1826813

ETH: 0x162b4862c2Aa74eB272974EdF91B754a57A5f01e

Tidak ada komentar:

Posting Komentar