Safinus — A Platform For Crypto Portfolio Managers & Investors

I’ve become very picky with ICOs lately. Most upcoming projects don’t need blockchain technology for the problem they’re solving and the main reason they launch ICOs is to by-pass traditional venture funding requirements; mostly in order to directly target less experienced investors.

That is why when I do come across the occasional gem that does actually need blockchain I start to pay attention. This has been the case for Safinus — a project that aims to not just use Blockchain, but allows experienced investors to invest the funds of less experienced investors in blockchain projects and startups in return for a profit share.

What is Safinus?

You can think of Safinus as a platform for Hedge Funds but for Cryptocurrencies instead of traditional stock investments, and with with an added benefit: the track record of all portfolio managers can be proven since performance of managers is stored on the blockchain ledger — something not possible with traditional managed funds.

How does it work?

Established investors create managed funds on the platform using their own money. They then trade on upcoming cryptocurrency startups and established coins. Their performance, either good or bad, is stored on the Safinus platform for other investors to see. Depending upon their performance, these managers may outperform or underperform coins such as Bitcoin or Ethereum, or indexes such as the Top 10 or Top 30 cryptocurrencies. In the event they outperform the market, other investors, particularly newbie investors, may wish to join the fund.

How much does it cost to join a fund?

Portfolio Managers may set their own cost of joining the fund, such as 10% of profits or so. Compared to institutional Hedge Funds which usually charge 20%+ on profits, it’s most likely the case that managers on the Safinus platform will offer lower fees since they will be directly competing with one another to attract new investors. This is another perk of the platform — since managers are always competing with one another and their performance is verifiable directly on the platform, newbie investors can’t be conned by joining poor Hedge funds like they can be with traditional Hedge funds.

Additional safeguards that don’t exist with traditional hedge funds

One of the things that most attracts me to this ICO and the project is the way the team has thought out various scenarios in-mind with the goal of protecting newbie investors. You see, traditional funds can easily set up “shell” corporations or fake companies and invest in these companies with investors funds, only to purposefully lose money on them in order to acquire profit in-directly. Whilst top hedge funds won’t do this, shady ones that target newbie investors sometimes do.

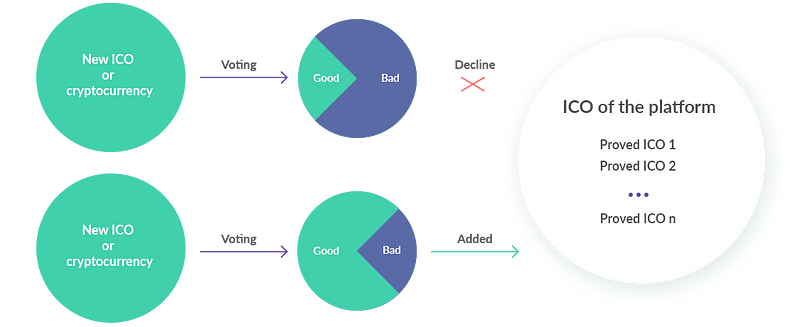

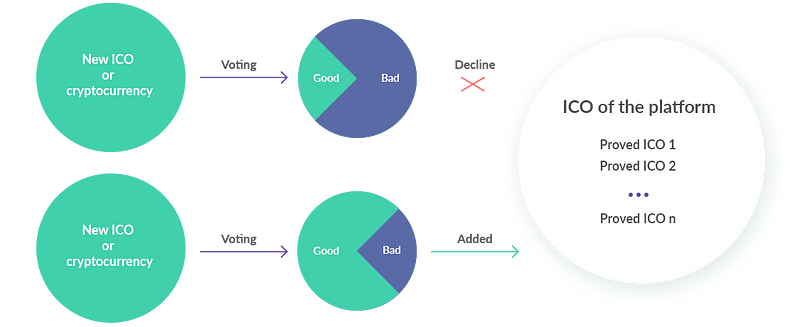

Fortunately, the Safinus platform has worked out a system to prevent this. All investment projects, including ICOs, that the portfolio manager wishes to invest in must first be approved by the majority of the Safinus community. This makes such scenarios as described above nearly impossible on the Safinus platform, since it’s incredibly unlikely the greater community would approve a shell company or scam startup.

Details of the ICO

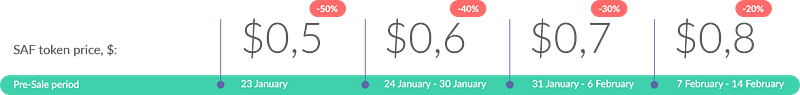

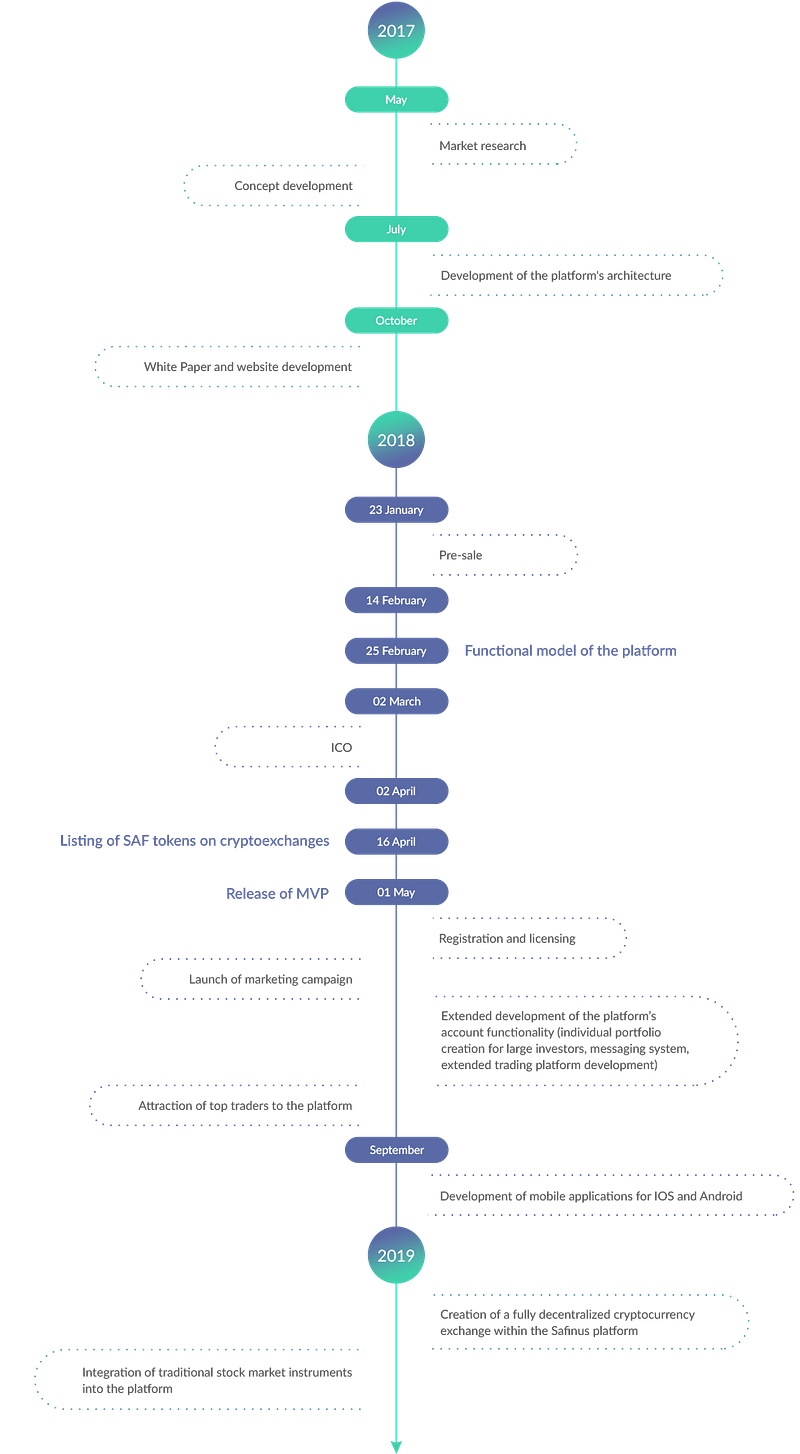

The Pre-ICO will be ending on February 14, so you should get in quickly if you wish to join now. Otherwise, you can wait for the main ICO which will run from 2 March 2018–2 April 2018. Final price of the project token will be $1 per SAF.

The token will be used as the utility token on the Safinus platform. In addition, portfolio managers must have 200 SAF tokens to be able to create a basic fund, with more advanced funds requiring additional tokens. As more hedge fund managers join the platform, the demand for SAF should increase.

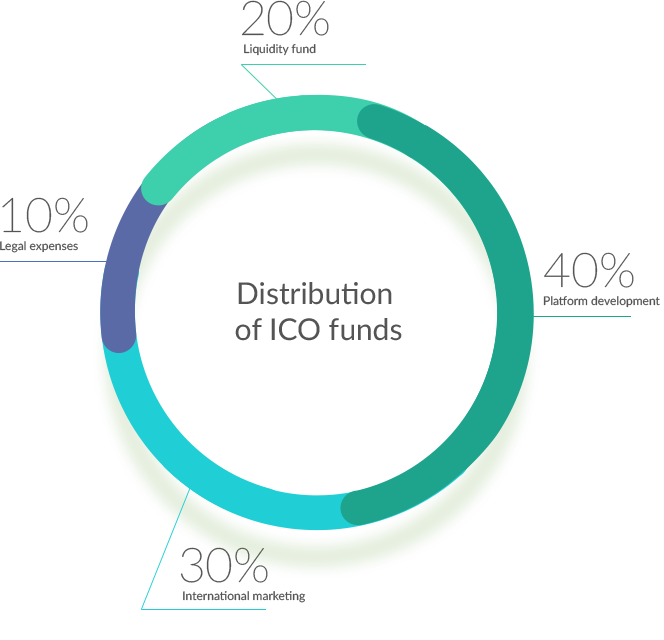

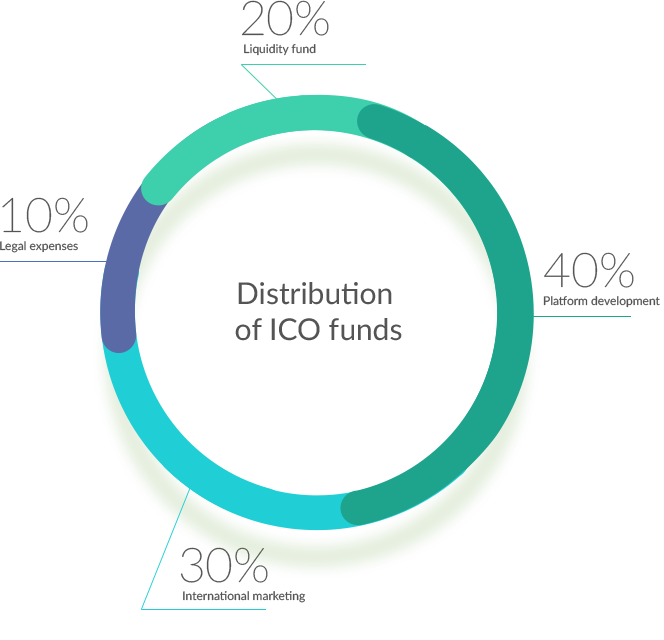

It’s good to see too that the distribution of ICO funds is mostly focused on platform development at 40% of the project funds, with marketing coming in at a close second with 30% of project funds. This should be good news for investors as the team will be focusing mostly on platform development and marketing to increase demand for the SAF token by driving platform adoption.

Roadmap

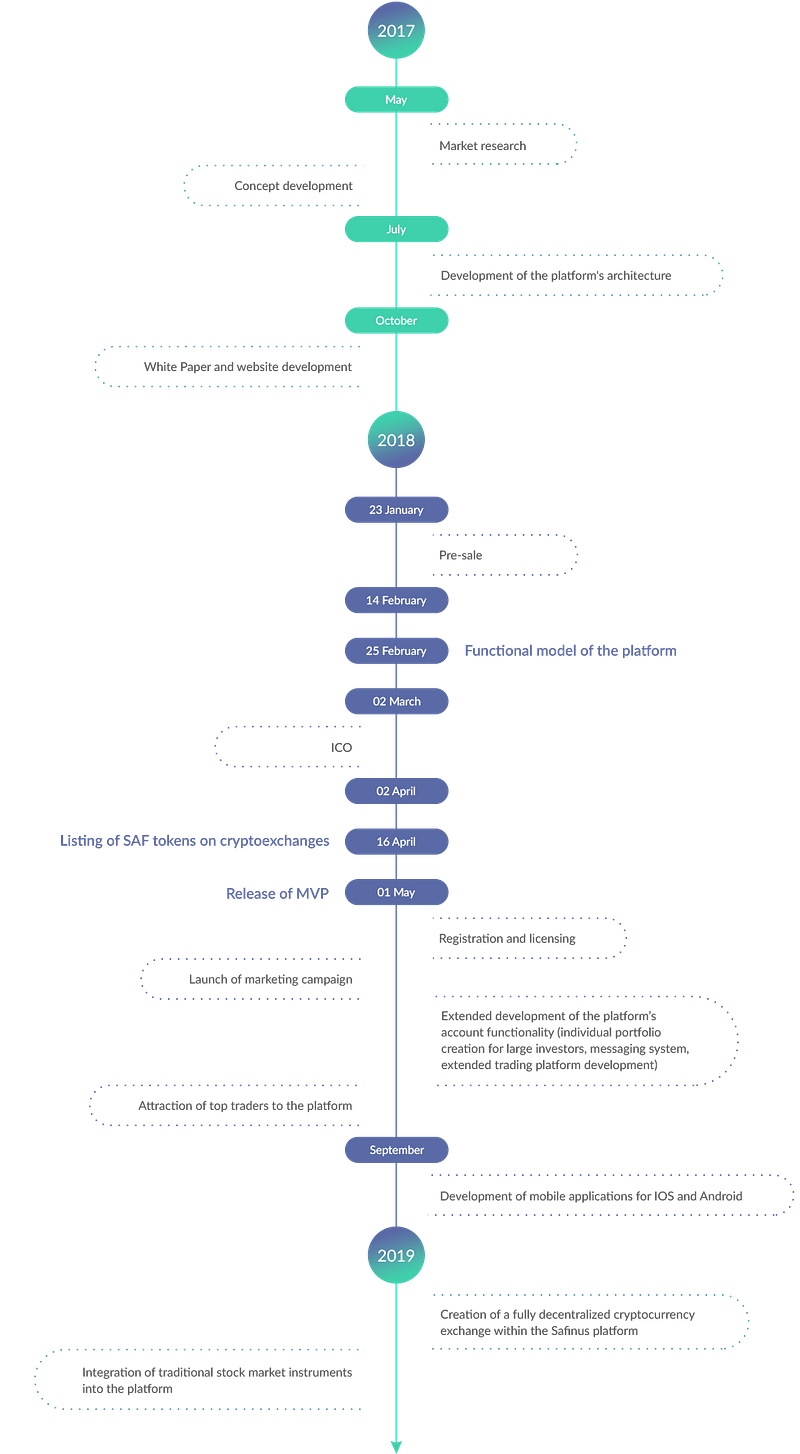

A basic version of the platform should already be launched by the end of February, even before the main ICO. This will give mainstream investors a chance to test things out before investing. Registration and licensing of the platform will begin in May, which hopefully will allow actual funds to begin operating soon after that.

Conclusion

As an overall, I recommend considering this ICO due to the reasons stated. Cryptocurrency is often scary for new investors since they lack the experience and knowledge to know which tokens to invest in. Also, due to the lack of regulations in crypto at the moment, newbies are very likely to fall for scam projects. By investing their funds directly with experienced portfolio managers with proven track records, newbies can allow these experienced investors to trade their funds for them at a small fee. I’m confident about this ICO since there’s a strong chance that this barrier to entry into crypto will be effectively eliminated, and newbies can now gain the same type of exposure to the cryto markets that experienced traders have.

Links -

Safinus ICO site: https://www.safinus.com/

Telegram: https://t.me/safinus

Whitepaper: https://www.safinus.com/whitepaper/

Blog: https://medium.com/@safinus.com

I’ve become very picky with ICOs lately. Most upcoming projects don’t need blockchain technology for the problem they’re solving and the main reason they launch ICOs is to by-pass traditional venture funding requirements; mostly in order to directly target less experienced investors.

That is why when I do come across the occasional gem that does actually need blockchain I start to pay attention. This has been the case for Safinus — a project that aims to not just use Blockchain, but allows experienced investors to invest the funds of less experienced investors in blockchain projects and startups in return for a profit share.

What is Safinus?

You can think of Safinus as a platform for Hedge Funds but for Cryptocurrencies instead of traditional stock investments, and with with an added benefit: the track record of all portfolio managers can be proven since performance of managers is stored on the blockchain ledger — something not possible with traditional managed funds.

How does it work?

Established investors create managed funds on the platform using their own money. They then trade on upcoming cryptocurrency startups and established coins. Their performance, either good or bad, is stored on the Safinus platform for other investors to see. Depending upon their performance, these managers may outperform or underperform coins such as Bitcoin or Ethereum, or indexes such as the Top 10 or Top 30 cryptocurrencies. In the event they outperform the market, other investors, particularly newbie investors, may wish to join the fund.

How much does it cost to join a fund?

Portfolio Managers may set their own cost of joining the fund, such as 10% of profits or so. Compared to institutional Hedge Funds which usually charge 20%+ on profits, it’s most likely the case that managers on the Safinus platform will offer lower fees since they will be directly competing with one another to attract new investors. This is another perk of the platform — since managers are always competing with one another and their performance is verifiable directly on the platform, newbie investors can’t be conned by joining poor Hedge funds like they can be with traditional Hedge funds.

Additional safeguards that don’t exist with traditional hedge funds

One of the things that most attracts me to this ICO and the project is the way the team has thought out various scenarios in-mind with the goal of protecting newbie investors. You see, traditional funds can easily set up “shell” corporations or fake companies and invest in these companies with investors funds, only to purposefully lose money on them in order to acquire profit in-directly. Whilst top hedge funds won’t do this, shady ones that target newbie investors sometimes do.

Fortunately, the Safinus platform has worked out a system to prevent this. All investment projects, including ICOs, that the portfolio manager wishes to invest in must first be approved by the majority of the Safinus community. This makes such scenarios as described above nearly impossible on the Safinus platform, since it’s incredibly unlikely the greater community would approve a shell company or scam startup.

Details of the ICO

The Pre-ICO will be ending on February 14, so you should get in quickly if you wish to join now. Otherwise, you can wait for the main ICO which will run from 2 March 2018–2 April 2018. Final price of the project token will be $1 per SAF.

The token will be used as the utility token on the Safinus platform. In addition, portfolio managers must have 200 SAF tokens to be able to create a basic fund, with more advanced funds requiring additional tokens. As more hedge fund managers join the platform, the demand for SAF should increase.

It’s good to see too that the distribution of ICO funds is mostly focused on platform development at 40% of the project funds, with marketing coming in at a close second with 30% of project funds. This should be good news for investors as the team will be focusing mostly on platform development and marketing to increase demand for the SAF token by driving platform adoption.

Roadmap

A basic version of the platform should already be launched by the end of February, even before the main ICO. This will give mainstream investors a chance to test things out before investing. Registration and licensing of the platform will begin in May, which hopefully will allow actual funds to begin operating soon after that.

Conclusion

As an overall, I recommend considering this ICO due to the reasons stated. Cryptocurrency is often scary for new investors since they lack the experience and knowledge to know which tokens to invest in. Also, due to the lack of regulations in crypto at the moment, newbies are very likely to fall for scam projects. By investing their funds directly with experienced portfolio managers with proven track records, newbies can allow these experienced investors to trade their funds for them at a small fee. I’m confident about this ICO since there’s a strong chance that this barrier to entry into crypto will be effectively eliminated, and newbies can now gain the same type of exposure to the cryto markets that experienced traders have.

Links -

Safinus ICO site: https://www.safinus.com/

Telegram: https://t.me/safinus

Whitepaper: https://www.safinus.com/whitepaper/

Blog: https://medium.com/@safinus.com

profile : https://bitcointalk.org/index.php?action=profile;u=1826813

Tidak ada komentar:

Posting Komentar